Estate Tax Exemption 2025 Nys

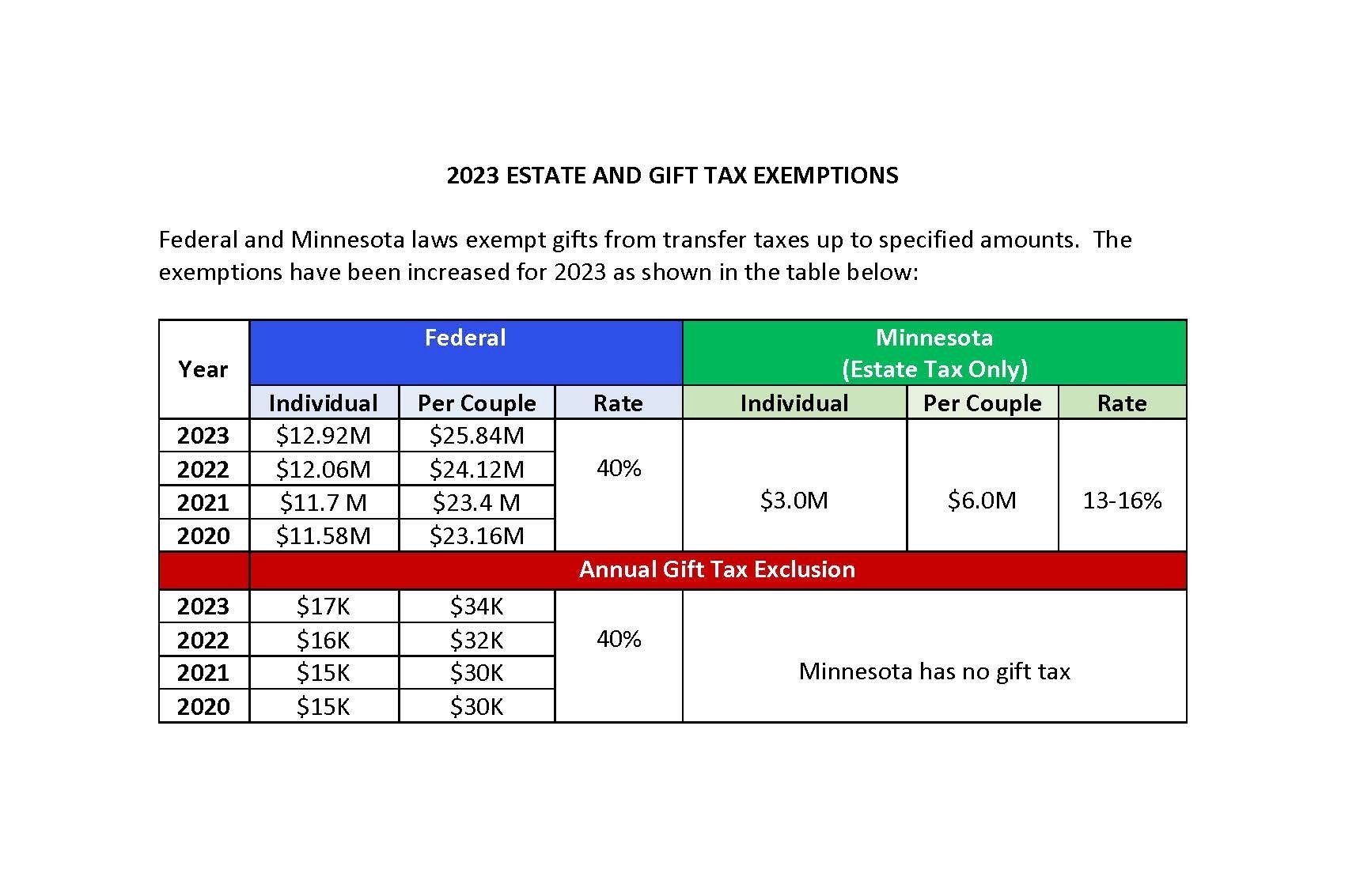

BlogEstate Tax Exemption 2025 Nys. The federal estate and gift tax exemption (the combined amount you can give away to beneficiaries other than your spouse or charities during life and at death. Before new legislation was passed in 2014, the new york exclusion amount was $1,000,000, and.

The estate tax is computed based on the new york taxable estate of a resident or nonresident using the following tax table: The state has set an estate tax exclusion amount, which for 2025 stands at $6,940,000, adjusted annually for inflation.

What Is The Nys Estate Tax Exemption For 2025 Halli Kerstin, Understanding taxation for ny estate planning.

Nys Estate Tax Exemption 2025 Alidia Arabella, Early estate planning is recommended to avoid a diminished legacy due to the new york estate tax.

Nys Estate Tax Exemption 2025 Fanya Jemimah, For the 2025 calendar year, the state allows a “basic exclusion”.

2025 Nys Estate Tax Exemption Devin Feodora, For the 2025 calendar year, the state allows a “basic exclusion”.

Ny State Estate Tax Exemption 2025 Loree Ranique, The federal estate tax exemption amount went up again for 2025.

Nys Gift Tax Exemption 2025 Joan Maryanne, For the 2025 calendar year, the state allows a “basic exclusion”.

Lifetime Gift And Estate Tax Exemption 2025 Erica Jacinda, When a spouse passes away, their estate plan will direct an amount equal to the new york estate tax exemption ($6.94 million in 2025).

2025 Estate Tax Exemption Dana Milena, This is the amount that a person can pass on to heirs at his or her time of death.

.jpg)

2025 Federal Estate Tax Exemption Amount Codee Devonna, For the 2025 calendar year, the state allows a “basic exclusion”.

:max_bytes(150000):strip_icc()/estate-tax-exemption-2021-definition-5114715-final-b76b790839b8411db1f967c82ef4b281.png)